Did you know that 45 SWIFT codes are used across various branches of a major Indian bank to facilitate international transactions? The SWIFT code is a unique identifier that enables secure and efficient global money transfers.

The SWIFT code is crucial for international banking, as it helps identify the bank and its specific branch. For customers of a prominent Indian bank, understanding the SWIFT code is essential for seamless international transactions.

Key Takeaways

- Understanding the importance of SWIFT codes in international banking

- Learning the structure and components of a SWIFT code

- Finding the correct SWIFT code for a specific branch

- Essential information needed for international wire transfers

- A comprehensive directory of SWIFT codes for easy reference

Understanding SWIFT Codes for Banking Transactions

Understanding SWIFT codes is essential for smooth banking transactions globally. SWIFT codes serve as unique identifiers for banks and financial institutions worldwide, facilitating international money transfers and communication between banks.

Also Read: District Cooperative Bank App: How to Register and Use It

What is a SWIFT Code and Why It’s Important

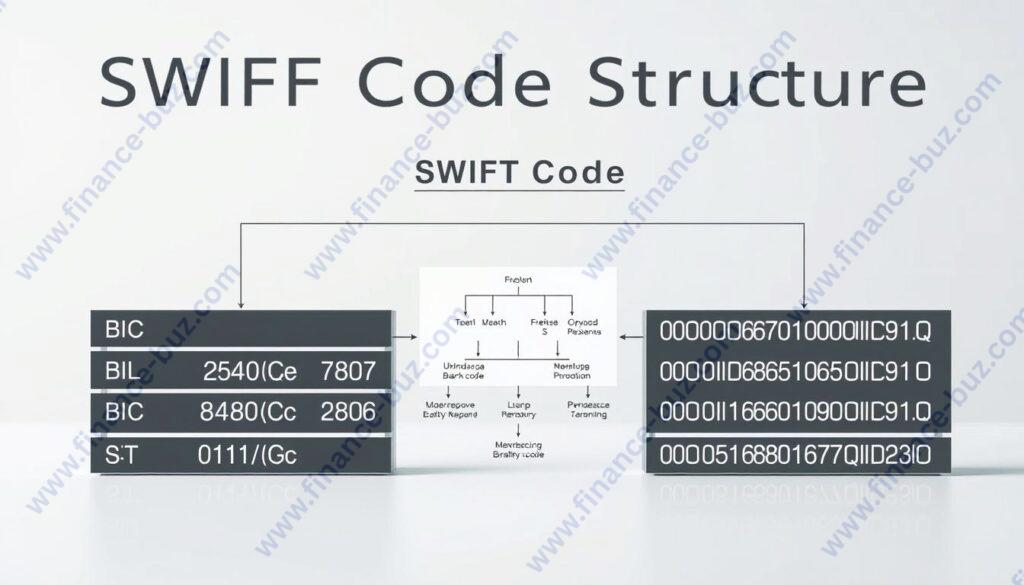

A SWIFT code, also known as a BIC (Bank Identifier Code), is an alphanumeric code that identifies a specific bank or branch. The code is used for international wire transfers, enabling banks to exchange messages and transfer funds securely. The SWIFT code is typically 8 or 11 characters long and contains information about the bank, country, location, and branch.

For customers of the Central Bank of India, knowing the SWIFT code is crucial when receiving international payments or sending wire transfers abroad. It ensures that funds are directed to the correct branch, reducing the risk of misdirected transactions.

How SWIFT Codes Facilitate International Money Transfers

SWIFT codes play a vital role in facilitating international money transfers by providing a standardized system for identifying banks and branches. This helps in eliminating confusion between similarly named banks in different countries.

| SWIFT Code Component | Description |

|---|---|

| First 4 characters | Bank Code (e.g., “CBIN” for Central Bank of India) |

| Next 2 characters | Country Code |

| Next 2 characters | Location Code |

| Last 3 characters (optional) | Branch Code |

By using SWIFT codes, banks can securely and efficiently transfer funds across borders. This standardized system ensures that international transactions are processed accurately and promptly.

Central Bank of India SWIFT Code Structure and Format

Understanding the structure of the Central Bank of India’s SWIFT code is essential for secure and efficient international money transfers. The SWIFT code is a unique identifier for banks and financial institutions worldwide, facilitating the exchange of financial messages in a secure and standardized manner.

Breaking Down the Components of SWIFT Codes

The SWIFT code for Central Bank of India is typically 8 or 11 characters long. It is composed of several elements that provide specific information about the bank and its branches. The code is structured as follows: the first four letters represent the bank code, the next two letters denote the country code, and the following two characters (letters or digits) signify the location code.

Decoding Central Bank of India’s Unique Identifier “CBIN”

The first four letters, “CBIN,” are the bank identifier code specifically assigned to Central Bank of India. This is followed by “IN,” the ISO 3166-1 alpha-2 country code for India, indicating the country where the bank operates. The location code “BB” signifies an active branch. For 11-character codes, the last three characters specify the branch code, while 8-character codes refer to the primary office.

Understanding this structure helps customers verify they’re using the correct SWIFT code for their specific Central Bank of India branch, preventing transaction errors and delays.

How to Find and Use Central Bank of India SWIFT Codes

Finding and correctly using your Central Bank of India branch’s SWIFT code is essential for seamless international transactions. The process involves several straightforward methods to ensure you have the correct information for your banking needs.

Also Read: Tata Coin Crypto Price Prediction, Benefits, and Future Insights

Methods to Locate Your Branch’s SWIFT Code

You can find your Central Bank of India SWIFT code through various reliable methods. Checking your bank statement is one of the simplest approaches, as the SWIFT code is typically printed for reference purposes. Alternatively, you can contact your Central Bank of India branch directly via phone, email, or in person to obtain the most accurate and up-to-date code information.

The Central Bank of India’s official website also offers a dedicated section where customers can search for SWIFT codes by entering their branch location or browsing through a comprehensive branch directory. Furthermore, mobile banking applications and internet banking portals for Central Bank of India customers often display the SWIFT code in the account information or international transfer sections.

Information Required for International Wire Transfers

When initiating an international wire transfer, you’ll need to provide comprehensive information, including the recipient’s full name, account number, address, the correct SWIFT code, transfer amount, currency, and sometimes the purpose of the transfer. It’s also crucial to verify the SWIFT code before completing the transaction to avoid failed transfers, delays, or additional processing fees.

| Information Type | Details Required |

|---|---|

| Recipient’s Details | Name, Address, Account Number |

| Bank Details | Name, Address, SWIFT Code of the Recipient’s Branch |

| Transfer Information | Currency, Amount, Purpose |

Complete List of Central Bank of India SWIFT Codes by Branch

Central Bank of India’s comprehensive directory of SWIFT codes is a valuable resource for individuals and businesses engaged in international trade. The bank has an extensive network of branches across major cities in India, including Mumbai, Delhi, Chennai, Kolkata, Bangalore, Pune, Hyderabad, and many others.

The directory includes 48 SWIFT codes for different Central Bank of India branches, organized alphabetically by city and branch name for easy reference. Some of the major metropolitan branches include Mumbai’s Overseas Branch (CBININBBOSB), Delhi’s Janpath Branch (CBININBBJAN), Bangalore City Branch (CBININBBBLR), and Chennai’s International Business Branch (CBININBBMDR).

Northern India branches are represented with codes for locations like Chandigarh (CBININBBSEC), Ludhiana (CBININBBLUD), Karnal (CBININBBKAR), Amritsar (CBININBBAMR), and multiple New Delhi branches. Southern India coverage includes branches in Chennai, Bangalore, Coimbatore (CBININBBCOB), Hyderabad (CBININBBHYD), Kochi (CBININBBWIS), Madurai (CBININBBMDU), and Tiruppur (CBININBBTIR).

Western India is served through branches in Mumbai (multiple locations including CBININBBBMO for Main Office), Pune (CBININBBPOO), Surat (CBININBBSUR), Rajkot (CBININBBRAJ), and Vadodara (CBININBBBAR). Eastern India branches include Kolkata’s Main Office (CBININBBCAL) and other regional centers that facilitate international banking services.

Each SWIFT code follows the standard format where CBIN represents Central Bank of India, IN stands for India, the next two characters indicate location, and the final three characters (when present) specify the exact branch. The International Division in Mumbai (CBININBB) serves as the primary contact for international banking relationships and correspondent banking services.

This directory is particularly valuable for businesses engaged in international trade, expatriates sending remittances to India, and individuals receiving overseas payments into their Central Bank of India accounts. Regular verification of SWIFT codes is recommended as they may occasionally be updated, especially when branches undergo restructuring or relocation.

Leave a Comment