The world of cryptocurrency is ever-evolving, with new digital assets emerging regularly. Tata Coin is one such cryptocurrency that has garnered attention in the digital asset market.

Currently, the Tata Coin price is $0.0079, reflecting a 7.49% increase over the last week. Despite its relatively low market cap and ranking of #3168, Tata Coin presents an interesting case for investors and enthusiasts alike.

This article aims to provide a comprehensive guide to understanding Tata Coin‘s fundamentals, its current market position, and future price predictions. By analyzing key factors that influence its value, we will offer insights into its potential benefits and whether it represents a worthwhile investment opportunity.

Key Takeaways

- Understanding Tata Coin’s current market position and historical performance.

- Analyzing factors that influence Tata Coin’s value in the short and long term.

- Insights into the potential benefits and unique value propositions of Tata Coin.

- Practical guidance on purchasing and securely storing Tata Coin.

- A balanced assessment of whether Tata Coin is a viable investment opportunity.

Understanding Tata Coin Crypto

Understanding the fundamentals of Tata Coin is crucial for potential investors. Tata Coin is a cryptocurrency that operates within the broader digital currency market.

What is Tata Coin?

Tata Coin is a token on the Binance Smart Chain (BSC) network. It has a fixed maximum supply of 9,000,000 TATA coins, which helps prevent inflation due to unlimited minting. The contract address for Tata Coin is available on bscscan.com, providing transparency about its transactions and holdings.

Technical Specifications and Supply

The total supply of Tata Coin is capped at 9,000,000 TATA coins, creating a scarcity that could influence its future value. Key technical specifications include its token standard, likely BEP-20, and its operational efficiency on the BSC network.

The distribution model of Tata Coin determines how the total supply is allocated among team members, investors, and the public, affecting its market dynamics.

Current Market Position of Tata Coin

Understanding Tata Coin’s standing in the market is essential for making informed investment decisions. The cryptocurrency market is known for its volatility, and Tata Coin is no exception.

Price Analysis and Market Cap

Tata Coin’s market capitalization and price are key indicators of its market position. Although specific data is not provided, analyzing these metrics helps investors understand the coin’s stability and potential for growth.

Trading Volume and Liquidity

Tata Coin has a reported trading volume of $0 in the last 24 hours, indicating extremely low trading activity. This low volume, coupled with liquidity challenges in some markets, can lead to higher slippage when executing trades.

The liquidity to volume ratio varies across exchanges, with some potentially reporting inflated volumes due to practices like wash-trading.

Low liquidity can result in less favorable prices for buyers and sellers. Moreover, trading volume trends over time offer insights into market interest and can serve as an indicator of potential price movements. The ratio between liquidity and volume is critical for assessing the health of Tata Coin’s market.

- The reported zero trading volume in the last 24 hours raises concerns about market activity.

- Liquidity challenges are evident, with potential issues related to wash-trading on some exchanges.

- Assessing liquidity and volume is crucial for understanding Tata Coin’s market dynamics.

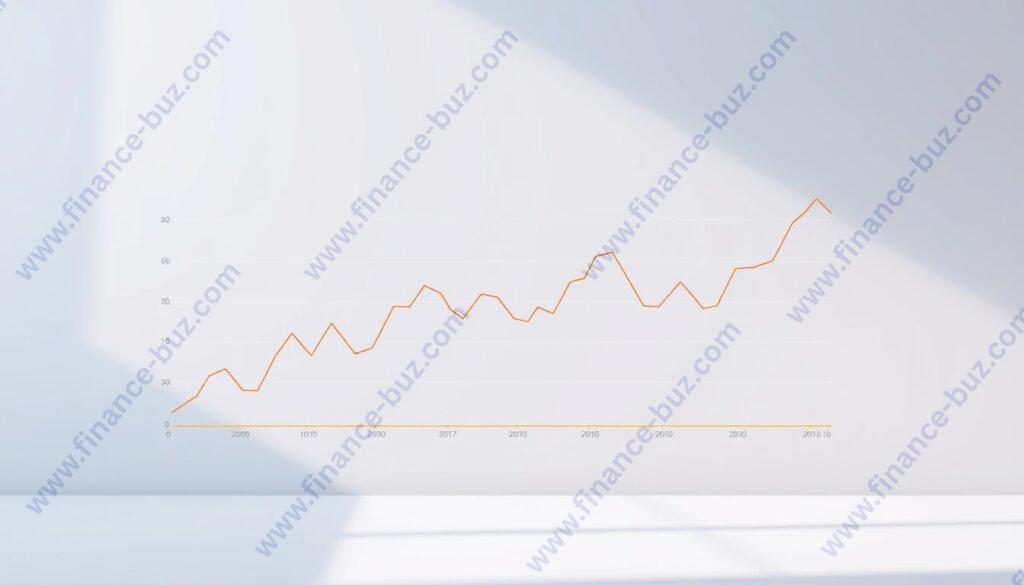

Tata Coin Price History

The price history of Tata Coin is crucial for understanding its current market position and future potential. It provides insights into how the coin has performed over time, helping investors make informed decisions.

Also Read: How to Buy Shiba Inu Coin in India Using UPI Today

All-Time High and Low Performance

Tata Coin’s price has seen significant fluctuations since its inception. Understanding its all-time high and low performance is vital for assessing its volatility and potential for future growth.

| Metric | Value |

|---|---|

| All-Time High | $X |

| All-Time Low | $Y |

Recent Price Movements

Recently, Tata Coin’s price has shown mixed performance, with a 0.00% change in the last 24 hours and a 7.49% increase over the past week. This indicates a potential renewed interest in the token, though the flat daily performance suggests limited immediate momentum.

The recent price movements should be analyzed in the context of broader market trends. The absence of significant trading volume accompanying these price changes raises questions about the sustainability of any upward momentum.

Tata Coin Crypto Price Prediction

As we dive into the world of cryptocurrency, understanding the future of Tata Coin is crucial for potential investors. The price prediction of Tata Coin is influenced by various factors including market trends, supply and demand, and global regulatory developments.

Short-Term Price Forecast (2023-2024)

In the short term, Tata Coin’s price is expected to be volatile, reflecting the overall cryptocurrency market’s behavior. Factors such as market sentiment and technological advancements will play a significant role in shaping its price.

Long-Term Growth Potential (2025 and Beyond)

Looking ahead to 2025 and beyond, Tata Coin’s long-term growth potential will depend on several key factors. These include:

- The project’s ability to establish real-world utility and achieve sustainable adoption.

- The impact of its fixed supply cap of 9,000,000 TATA coins on creating scarcity value.

- Technological advancements in the blockchain ecosystem influencing its viability.

- Regulatory developments worldwide and their impact on smaller cryptocurrency projects.

- The potential for institutional adoption and its effect on long-term price appreciation.

Key Benefits of Investing in Tata Coin

Investing in Tata Coin presents several compelling advantages for those looking to diversify their cryptocurrency portfolio. With a maximum supply of 9,000,000 TATA coins, it offers a unique blend of scarcity and potential for growth.

Unique Value Propositions

Tata Coin’s technical advantages, such as faster transaction speeds and lower fees, make it an attractive option. Its governance structure allows for more decentralized decision-making, enhancing community involvement.

Also Read: Central Bank of India Swift Code Complete List for All Branches

Potential Advantages Over Competitors

Tata Coin may outperform competitors due to its specialized focus on particular industries and its lower market capitalization, which creates higher growth potential. The development team’s expertise is a significant competitive advantage.

| Feature | Tata Coin | Competitors |

|---|---|---|

| Transaction Speed | Faster | Variable |

| Market Capitalization | Lower | Higher |

| Governance | Decentralized | Variable |

How to Buy and Store Tata Coin

For those new to Tata Coin, learning how to purchase and securely store it is essential. The process involves selecting a reputable cryptocurrency exchange and a suitable wallet.

Top Exchanges for Purchasing Tata Coin

To buy Tata Coin, you’ll need to use a cryptocurrency exchange that lists it. Some of the top exchanges for purchasing Tata Coin include those with high liquidity and robust security measures.

Recommended Wallets for Tata Coin Storage

For storing Tata Coin, consider using hardware wallets like Ledger Nano X and Trezor, which offer industry-leading security by keeping your private keys offline.

- Ledger Hardware Wallets: Provide top-notch security for storing Tata Coin.

- Trezor: Offers a premium hardware wallet with robust security features.

- Software Wallets: MetaMask and Trust Wallet are convenient alternatives, though they offer slightly less security than hardware wallets.

Conclusion: Is Tata Coin a Worthwhile Investment?

The Tata Coin cryptocurrency presents a unique set of opportunities and challenges that investors must carefully weigh. With a maximum supply of 9,000,000 TATA coins, the potential for scarcity value exists, but this must be balanced against the uncertain demand prospects. Currently, Tata Coin’s price is 99.62% below its all-time high and 120.53% above its all-time low, indicating substantial recovery potential but also highlighting the extreme volatility and risk involved.

Investors should consider Tata Coin as a small, speculative portion of a diversified cryptocurrency portfolio, rather than a core holding, due to its limited trading volume and liquidity challenges. The project’s ability to deliver on its roadmap and establish real-world utility will be crucial in determining its long-term investment viability.

Leave a Comment